May 25, 2022

Expanded Free COVID-19 Testing & Mask Advisory

February 24, 2022

City of Cambridge Mask Requirement for Indoor Public Places Will End on Sunday, March 13, 2022

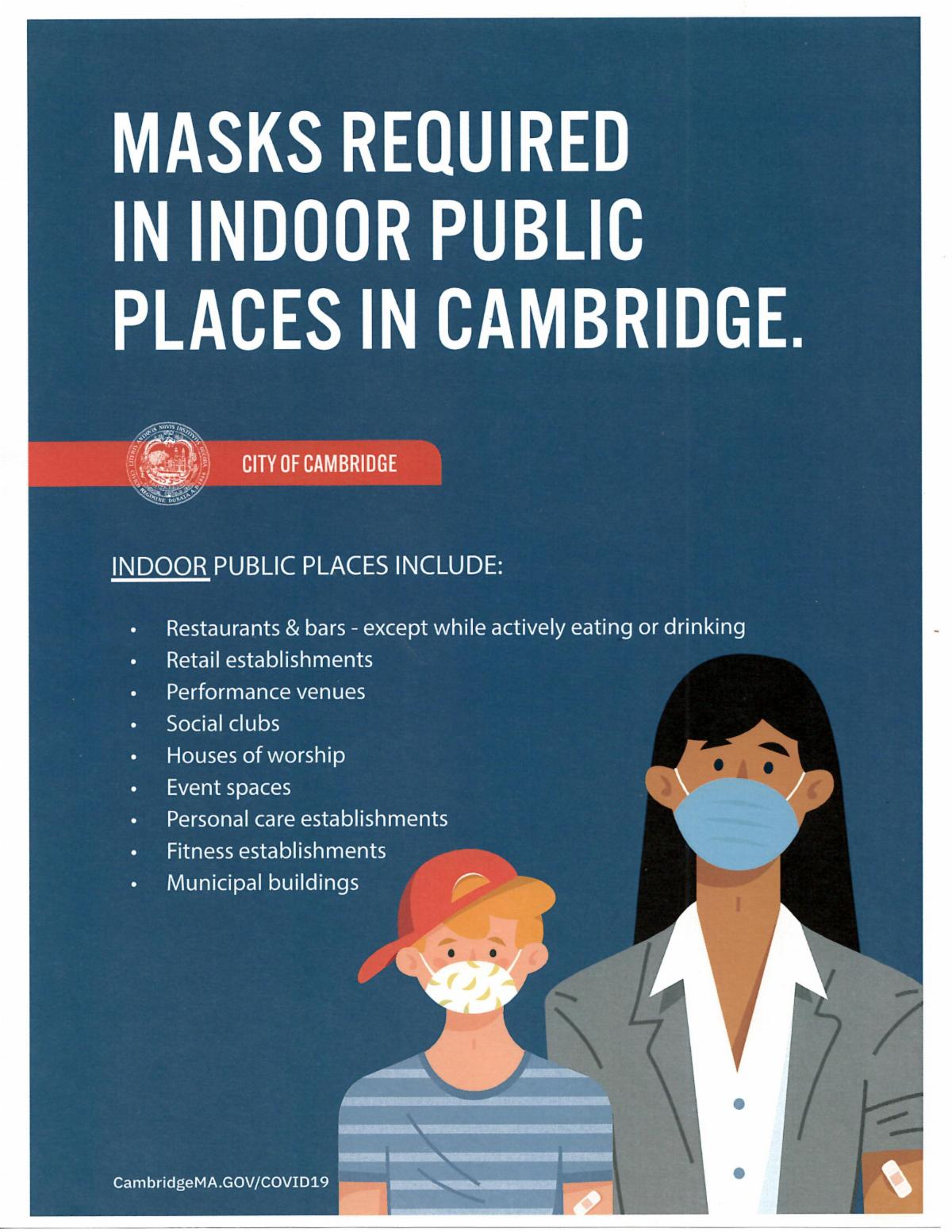

| The City of Cambridge has announced that due to the sustained improvement to the City’s COVID-19 metrics over the past month, Cambridge will lift its mask requirement for indoor public places effective at 11:59 p.m. on Sunday, March 13, 2022. Cambridge has seen a steady decrease in reported cases, test positivity, and COVID-19 virus detection in the City’s municipal wastewater monitoring program. Additionally, according to data from the Massachusetts Department of Public Health, 92% of residents have received at least one dose of a COVID-19 vaccine, 76% of residents are fully vaccinated, and 45% have received a booster dose. Effective Monday, March 14, 2022, the City of Cambridge will follow the Massachusetts Department of Public Health’s mask advisory for vaccinated and unvaccinated residents consistent with the Centers for Disease Control and Prevention’s mask guidance and will not require the use of face masks in indoor public places in Cambridge. The City encourages residents to follow the Massachusetts Department of Public Health and CDC recommendations for vaccinated and unvaccinated people, and businesses are reminded that they may continue to require the use of face masks inside their establishments if they wish. Consistent with the City’s phased approach to reopening City buildings and programs, masks will continue to be required for all employees and visitors in municipal buildings, regardless of vaccination status, through Sunday, March 27, 2022. The updated Emergency Order Requiring Use of Face Masks in Indoor Public Places is available here. For more information and regular COVID-19 updates, visit www.cambridgema.gov/covid19 to sign up for daily City email updates. |

January 5, 2022

The City of Cambridge today amended its emergency order requiring that face masks or coverings be worn in indoor public places to include common areas of residential buildings with at least four units as well as common areas of office and laboratory buildings. The order applies to everyone over the age of two years old, with exceptions in alignment with the Centers for Disease Control and Prevention and the Massachusetts Department of Public Health guidelines. This amended order takes effect on Friday, January 7, 2022 at 12:01 a.m.

For the purposes of the amended order, Indoor Public Places include, but are not limited to:

- Common areas of residential buildings with at least four units such as any lobby, hallway, elevator, stairwell, laundry room, garage, fitness center/gym, etc.

- Common areas in indoor office and laboratory buildings such as any lobby, hallway, elevator, stairwell, garage, fitness center/gym, etc.

- Retail establishments

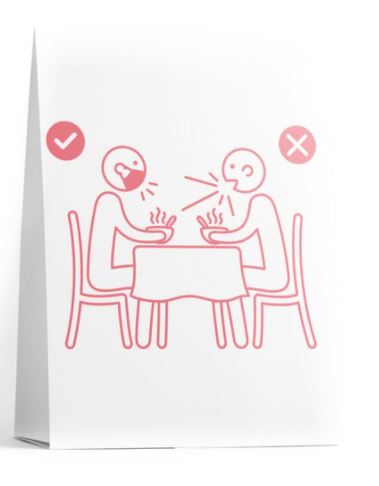

- Restaurants & bars – except while actively eating or drinking

- Performance venues

- Social clubs

- Houses of worship

- Event spaces

- Municipal buildings

- Personal care establishments

- Fitness establishments

The City also announced temporary restrictions on City public meetings and indoor City events due to COVID-19. All public meetings of City committees, advisory groups, community meetings and the like shall be conducted as remote meetings, rather than in-person meetings. No City-sponsored community events or City-sponsored public gatherings shall take place indoors. Such events may continue when conducted outdoors if participants are masked and are able to physically distance. This does not apply to City-sponsored youth activities or youth sports, or other City-sponsored athletic programs, which may continue to take place indoors.

Additional information is available here: https://www.cambridgema.gov/covid19/News/2022/01/maskandevents

December 14, 2021

FOR IMMEDIATE RELEASE:

December 13, 2021

CONTACT

Terry MacCormack

Terry.maccormack@mass.gov

Governor Baker Signs $4 Billion Federal COVID-19 Relief Funding Spending Bill

BOSTON — Governor Charlie Baker today signed a $4 billion spending plan to support continued recovery across key priority areas, making substantial investments in housing and homeownership, healthcare, workforce development, premium pay for essential workers and infrastructure. The funding, first proposed by the Baker-Polito Administration in June of 2021, will put to work a portion of the Commonwealth’s direct federal aid from the American Rescue Plan Act (ARPA).

“The pandemic has had a significant impact on Massachusetts workers, families, communities, and businesses for nearly two years, and today’s signing directs billions of dollars in relief toward those hardest hit across the Commonwealth,” said Governor Charlie Baker. “While this package falls far short of the investment I called for to address the housing shortage, the important investments included in this bill will help to accelerate Massachusetts’ economic recovery and provide long-lasting benefits to infrastructure, healthcare, education systems, and small businesses.”

“The funding allocated in this bill addresses critical areas of need across the

Commonwealth, from addiction services to housing availability to environmental infrastructure,” said Lieutenant Governor Karyn Polito. “This relief will play a crucial role in the ongoing recovery of our residents and communities, especially those disproportionately impacted by COVID-19, and we are eager to put it to work.”

The bill authorizes up to $2.55 billion in spending from the $5.286 billion ARPA Coronavirus State Fiscal Recovery Funds provided to Massachusetts in May 2021. This direct federal aid is intended to support urgent COVID-19 response efforts, replace lost revenue, support immediate economic stabilization for households and businesses, and address unequal public health and economic challenges in Massachusetts cities and towns. After accounting for spending in this bill and previously announced commitments, approximately $2.3 billion of the Coronavirus State Fiscal Recovery Funds will remain to be further appropriated.

“The Commonwealth has worked diligently over the past two years to deploy billions worth of federal support to strengthen our economic recovery, support those in disproportionately impacted communities, and get people back to work,” said Secretary of Administration and Finance Michael J. Heffernan. “We appreciate the collaboration of our colleagues in the Legislature on this bill to invest in healthcare, housing, and the Massachusetts workforce and look forward to even more critical investments in 2022 with the remaining ARPA funds.”

Coupled with the authorized ARPA dollars, $1.45 billion in spending is appropriated from the Transitional Escrow Fund, made up of state fiscal year 2021 surplus funds. The bill assigns the Secretary of Administration and Finance the responsibility of matching expenditures to the most appropriate funding source, which provides important flexibility in recognition of the significant federal rules and regulations associated with federal funds.

Highlights of the plan include:

Housing

- $150 million to finance the statewide production of housing for various populations, including seniors and veterans;

- $150 million for public housing maintenance;

- $115 million for rental housing production and to provide increased housing options to residents of disproportionately impacted communities;

- $115 million to support housing production in disproportionately impacted communities through MassHousing’s CommonWealth Builder Program and similar efforts;

- $65 million to support expanded homeownership opportunities, focused on first-time homebuyers who are residents of disproportionately impacted communities.

Health Care

- $400 million for addiction treatment and related behavioral health services, workforce, and infrastructure;

- $260 million for fiscally stressed hospitals in disproportionately impacted municipalities;

- $200 million for local and regional public health, including local boards of health staffing, technology, and training;

- $50 million for workforce retention and capital improvements at nursing facilities and $30 million to support loan repayment, retention, and recruitment programs for human service workers;

- $37.5 million for grants to reduce juvenile delinquency, youth homelessness, and summer jobs.

Workforce Development

- $500 million to support the Unemployment Compensation Trust Fund;

- $500 million for premium pay for low-income essential workers;

- $107.5 million for workforce and career technical skills training;

- $24.5 million for workforce development and capital grants to YMCAs and Boys & Girls clubs.

Economic Development

- $135 million to support cultural facilities and tourism assets throughout Massachusetts;

- $75 million for grants to small businesses, $50 million of which will go to businesses reaching underserved markets and minority, women, and veteran owned businesses. $25 million will be reserved for small businesses that did not qualify for prior programs.

Infrastructure Investment

- $100 million to fund grants for water and sewer infrastructure improvements;

- $100 million to improve culverts, dams, and other environmental infrastructure;

- $90 million for marine port development;

- $50 million to close the digital divide and increase broadband internet access;

- $44.8 million for food security;

- $25 million for greening gateway cities.

Education

- $105 million for a variety of education supports, including recovery grants to state universities and community colleges, workforce support for special education schools, and support for recruiting educators of color;

- $100 million for public school district HVAC grants;

- $100 million for capital grants to vocational high schools and career technical education programs.

The Governor vetoed language in seven line items containing requirements that would cause delays in putting funds to use.

Of 88 outside sections included in the bill, the Governor signed 86, including one that excludes federal Paycheck Protection Program (PPP) loans, Economic Injury Disaster Loan (EIDL) advances, Shuttered Venue Operators grants, Restaurant Revitalization Fund grants, and SBA loans from taxable income for individual taxpayers for all applicable tax years, creating parity with corporate taxpayers.

Governor Baker returned one outside section to the Legislature with proposed amendments and vetoed one outside section. Notably, while signing outside sections that establish and fund a $500 million COVID-19 Essential Employee Premium Pay Fund for one-time payments to frontline workers, the Governor vetoed a section setting up administrative obstacles that would interfere with the efficient distribution of payments, including the requirement to consult with an extensive 28-member advisory panel on program design. Vetoing this section will allow the administration to immediately get to work on the process to distribute these funds.

To read the Governor’s signing letter, click here.

To read the Governor’s signed amendment letter, click here.

To read attachments to the signed amendment letter, click here.

###

June 2, 2021

Dear Licensee:

As you are aware, the COVID-19 restrictions have been lifted, including the requirement that tables and chairs be set 6 feet apart. As you may have also seen from the Board’s vote of last week, we have committed to ensuring that the temporary extensions be extended through the date sought by the Governor’s pending legislation (November 29, 2021), or in the alternative through the end of the year, whichever is sooner.

Since at least part of your currently approved temporary extension is on the public way, if you want to continue using it past August 15, 2021 (the current expiration date per the end of the state of emergency and your agreement with the City), then you need to complete the attached document and submit to extend the use through the date approved by the legislature (11/29/21) or December 31, 2021, whichever is sooner. In addition, if you also want to rework your floor plan to add additional seats, then please make sure to select the proper portion of the agreement (3b) and attach an updated floor plan. If you are NOT changing your currently approved floor plan, you must mark off 3a.

When you complete the agreement, upload it to your temporary extension agreement, or email to me and I will upload it for you. If you plan to use the outdoor area past August 15, 2021, you must complete this process prior to that date.

Any questions, please let me know.

Thank you, stay safe.

Nicole Murati Ferrer, Esq., ChaiCambridge License Commission

Pole and Conduit Commission

831 Massachusetts Avenue

Cambridge, MA 02139

(617) 349-6140

Website: www.cambridgema.gov/license

Application/Renewal Portal: https://cambridgema.viewpointcloud.com/

May 21, 2021

May 7, 2021

April 30, 2021

Dear All (long email, sorry, but please read through):

After consultation with public health officials, on Thursday, May 6, 2021, the City of Cambridge will advance to Phase IV, Step 1. Attached are the relevant State and City orders as well as the summary of sector specific guidelines which must be followed (all of the sector protocols and checklists can be accessed at: https://www.mass.gov/resource/reopening-sector-specific-protocols-and-best-practices). Below are some highlight of what moving into Phase IV, Step 1 entails:

- Any licensee currently licensed for entertainment will be able to offer this amenity subject to sector-specific guidelines limitations. Note that dance floors/dancing by patrons continues to be prohibited except at private events. Some other required guidelines are: spacing limitations; separate areas; and no singing indoors. Since some of you “eliminated” entertainment from your licenses during renewals, you must email me to confirm the amenity is in place.

- Gatherings Limits at indoor and outdoor events have increased to 100 inside, 150 outside.

- “Bars” a/k/a drinking only establishments and “nightclubs” continue to be closed.

- Indoor performance venues used for live performances and other indoor performance spaces not designated as Phase IV, Step 2 enterprises may commence operating; submission of a plan, post inspection by ISD are no longer required. Alcohol only service continues to be prohibited.

Reminders/Updates:

- Face mask order is updated as of this Friday, April 30. Although the City is adopting the State’s Order, it is requiring the use of face masks under additional circumstances. For the businesses herein, face mask use continues to be as is – required at all times except when actively consuming food or beverages.

- Service of alcohol only is prohibited. You must serve food with alcohol. Table limitations remain at 6 people maximum, and service is capped at 90 minutes per table.

- 2021 Renewal Fee Balances for licensees who renewed in October-December 2020 are due May 31, 2021.

- If you are in the process of re-opening and you license has not yet issued, contact me immediately to reactivate your record to ensure your license issues promptly.

- The City continues to contract with local restaurants to provide food to the City’s homeless community during the COVID-19 public health crisis. Weekly requests for quotes are sent out to interested restaurants on Monday afternoons. Restaurants with additional questions or who are interested in participating in this initiative or should contact the City of Cambridge Purchasing Department at purchasing@cambridgema.gov.

- SBA – Restaurant Revitalization Fund opens May 3, 2021, for information: https://www.sba.gov/about-sba/sba-newsroom?utm_medium=email&utm_source=govdelivery.

- The City continues to host multi-department virtual office hours for businesses. To register, please visit: camb.ma/SmallBizHours. Next meetings: May 4 and 18, 2021, 3:00-4:00 PM.

As always, if you have any questions, let us know.

Thank you, stay safe.

Nicole Murati Ferrer, Esq., Chair

Cambridge License Commission

Pole and Conduit Commission

831 Massachusetts Avenue

Cambridge, MA 02139

(617) 349-6140

Website: www.cambridgema.gov/license

Application/Renewal Portal: https://cambridgema.viewpointcloud.com/

If you have any pronoun preferences, please let me know in your reply.

March 22, 2021

City of Cambridge Extends Restrictions on Public Events and Announces Cambridge will Remain in Phase III, Step 2 of Commonwealth’s Reopening Plan and Limit Gathering Sizes

The City of Cambridge announced today that it will not advance to Phase IV, Step 1 of the Commonwealth’s Reopening Plan and will remain in Phase III, Step 2 until further notice. The City will also restrict gathering limits for event venues and in public settings to 50 people indoors and 100 people outdoors. Cambridge’s new gathering limits are more restrictive than the Commonwealth. Outdoor gatherings at private residences and in private backyards will remain at a maximum of 25 people, with indoor house gatherings remaining at 10 people.

In addition, the City of Cambridge announced that it is extending the current prohibition on City-sponsored community events, events permitted for the use of City parks, or other City-sponsored public gatherings through May 31, 2021. The City has not permitted events or gatherings through its special events process since March 16, 2020 and is continuing this prohibition as part of its overall COVID-19 prevention strategies.

“The City’s team considers many factors when making decisions, including available science and local, regional, statewide, and national data trends. Remaining in Phase III, Step 2 is aligned with our ongoing strategy,” said City Manager Louis A. DePasquale. “If public health data trends shift, the City will reevaluate Cambridge’s reopening status, just as we have done throughout the pandemic. The City’s conservative approach to its phased reopening balances our efforts to minimize the public health impacts of COVID-19 with providing vital support to our residents and local business.”

Read full text of the City of Cambridge Temporary Emergency Order Delaying Phase IV, Step 1 of the Commonwealth’s Reopening Plan and Concerning Gatherings in the City of Cambridge Issued on March 22, 2021.

Read full text of the Amended Temporary Emergency Restrictions on City Public Meetings, City Events, and City Permitted Events Due to COVID-19.

The Emergency Order issued by the City on February 26, 2021 prohibiting live musical performances at restaurants remains in place, and indoor performance venues eligible to open under Phase III, Step 2 will need approval from the City of Cambridge Inspectional Services Department prior to opening.

While the ongoing rollout of the Commonwealth’s vaccination plan is encouraging, the City of Cambridge will continue to take a cautious and measured approach to activities and industries permitted in Cambridge and will continue to closely monitor public health data as part of its decision-making process.

It remains critical for the public to continue to wear high-quality and properly fitting face masks, practice social distancing, regularly wash hands, and limit the size of gatherings with people outside their immediate household.

Residents are reminded that the City of Cambridge provides free daily COVID-19 testing at various sites across the City. Appointments and additional information about this program are available at www.cambridgema.gov/testing.To stay up-to-date for the latest information on the COVID-19 vaccine from the City and the state, visit www.cambridgema.gov/vaccine.

For more information and to sign up to receive updates on COVID-19, please visit the City’s dedicated COVID-19 information page: www.cambridgema.gov/covid19.

March 3, 2021

In September 2020, the City of Cambridge announced it would be extending outdoor dining in the City until 60 days after the end of the Commonwealth’s declared state of emergency.

The City met with the business and restaurant communities to plan for what a four-season outdoor dining experience would look like, including planning for winter weather operations and creating opportunities to make the dining experience as safe, comfortable, and enjoyable as possible through things like the City’s Patio Heater Reimbursement Program.

While we cannot predict when the state of emergency will be declared over by the Governor, the City of Cambridge will work with affected businesses to find a way to support and assist them in identifying mechanisms to legally maintain their outdoor area and keep it operational through the end of the calendar year.

The following are some important information and reminders for restaurants related to Outdoor Dining Areas in Cambridge:

- If you were approved for a Temporary Extension of the Licensed Premises to an Outdoor Area Due to COVID-19 (“Temporary Premises Extension”) and provided proof of right to occupy the space after 11/1/2020, your permit expiration was amended and you remain permitted to use the temporary outdoor area up to 60 days after the Governor ends the state of emergency due to COVID-19.

- You do not need to reapply to use the same area. You can confirm whether your permit is up-to-date by looking at the expiration date on it (should say: “Expires 60 days after the end of the state of emergency as declared by the Governor of Massachusetts”).

- If you have an up-to-date permit, you can use your outdoor area.

- If in the public way make, be sure you clear it with the Department of Public Works and the Traffic and Parking Department:

- Email rlinke@cambridgema.gov at Public Works

- Email bmckenna@cambridgema.gov at Traffic & Parking Dept.

- If in the public way make, be sure you clear it with the Department of Public Works and the Traffic and Parking Department:

- If you have a Temporary Premises Extension but the expiration date says 11/1/2020, upload the document(s) necessary for the extension as detailed on the attached to your record or by emailing them to license@cambridgema.gov to obtain approval for the expiration update.

- If you have a Temporary Premises Extension but want to amend it, please submit an application at https://cambridgema.viewpointcloud.com/categories/1096/record-types/6771.

- If you did not get a Temporary Premises Extension, you can apply for one at: https://cambridgema.viewpointcloud.com/categories/1096/record-types/6771.

- You can find information as to what documents you need to upload at: https://www.cambridgema.gov/Departments/licensecommission.

- If you obtained a permit from the Fire Department to have propane heaters on the outdoor area, that permit has also been automatically extended through 60 days after the state of emergency ends (even though the expiration date on your permit does not reflect it).

- If you did not get a permit to have propane heat on an outdoor area or have any questions regarding your permit, please contact the Fire Department by emailing ctowski@cambridgefire.org.

- Restaurants have the ability to be reimbursed up to $250.00 per portable patio heater for up to a maximum of five (5) patio heaters per business. This reimbursement is subject to compliance with regulations and requirements of the Cambridge Fire Department.

- For questions on heater reimbursement, contact Matt Nelson, Assistant to the City Manager, by email at mnelson@cambridgema.gov or 617-349-4266.

- To set up an alternate heat source in the outdoor area, please contact Inspectional Services Department by emailing ranjits@cambridgema.gov.

- If you did not get a permit to have propane heat on an outdoor area or have any questions regarding your permit, please contact the Fire Department by emailing ctowski@cambridgefire.org.

February 26, 2021

City of Cambridge to Advance to Phase III, Step 2 of Commonwealth Reopening Plan on March 1, 2021, with Limited Exceptions

The City of Cambridge announced today that, effective Monday, March 1, 2021, the City will advance with the Commonwealth of Massachusetts to Phase III, Step 2 of the Commonwealth’s reopening plan, with limited exceptions. An Emergency Order issued by the City is prohibiting live musical performances at restaurants until further notice and delaying the opening of indoor performance venues until March 22, 2021. Prior to opening, indoor performance venues will also need approval from the City of Cambridge Inspectional Services Department.

Effective Monday, March 1, capacity limits across all sectors with capacity limits will be raised to 50 percent, excluding employees, and restaurants will no longer have a percent capacity limit. Restaurants in Cambridge will not be permitted to host live musical performances. They will be required to continue to enforce six-foot distance between tables, limit seating to six people per table, adhere to the maximum 90-minute time limit per table, and require that food be served with alcohol orders. As a reminder, restaurant customers may only remove face coverings in the actual act of eating and drinking. Face coverings are required at all other times while seated at tables and when wait staff are present at tables.

Food court seating must remain closed during this phase of reopening.

The continued downward trend in COVID-19 metrics and the ongoing rollout of the Commonwealth’s vaccination plan allows the City of Cambridge to advance to Phase III, Step 2. While the economy continues to reopen, it remains critical for the public to continue to wear high-quality and properly fitting face masks, practice social distancing, regularly wash hands, and limit the size of gatherings with people outside their immediate household. Additionally, current outdoor gatherings at private residences and in private backyards remain at a maximum of 25 people, with indoor gatherings at private residences remaining limited to 10 people.

Read full text of the City of Cambridge Temporary Emergency Order Advancing to Phase III, Step 2 the Commonwealth’s Reopening Plan with Certain Exceptions Issued on February 26, 2021.

Residents are reminded that the City of Cambridge provides free daily COVID-19 testing at various sites across the City. Appointments for March and additional information about this program are available at www.cambridgema.gov/testing

For more information and to sign up to receive updates on COVID-19 and vaccine-related information, please visit the City’s dedicated information page: www.cambridgema.gov/covid19.

https://www.cambridgema.gov/covid19/News/2021/02/cityofcambridgephase3step2

—

From: Murati Ferrer, Nicole <nmuratiferrer@cambridgema.gov>

Sent: Friday, February 26, 2021 2:14 PM

Subject: COVID-19: CAPACITY RESTRICTIONS ON RESTAURANTS LIFTED

Importance: High

Dear All:

Pursuant to the Governor’s announcement of yesterday, and after consultation with public health officials, effective Monday, March 1, 2021, City of Cambridge restaurants may operate at their maximum licensed seating capacity so long as there is a six foot distance between tables. Please note the maximum seating capacity is listed on your license. You must go off your seating capacity (not the total occupancy) as listed on your license (not your Certificate of Inspection); employees do not count towards the maximum seating capacity. The sector specific guidelines and City-mandated limitations must continue to be followed, which include but are not limited to:

- All tables and chairs must remain 6 feet apart from each other and high foot traffic areas, unless separated by a non-porous divider.

- The maximum party size at a table or approved bar seating area is 6 patrons.

- Maximum time per table/party is 90 minutes total. Eat-in service is only approved to seating patrons, no standing service allowed.

- Face masks must be worn by all employees, unless unsafe due to a medical condition or disability.

- Patrons must keep their masks on at all times except when actively engaged in consuming food or beverage (if waitstaff is at table, patrons must wear their face mask). Exceptions to this requirement are people under 2 years old and those who cannot wear a mask because of a medical condition or disability.

- No live music entertainment in restaurants is allowed. We will continue to evaluate the trends and discern how this amenity can be safely added.

- [Alcohol Licensees] Bar only service is not allowed; food must be served with alcohol. You may seat persons at the bar for food and alcohol service only if you have been inspected and approved by Inspectional Services Department (see Cambridge Order dated September 25, 2020).

Food court seating areas are not yet allowed to re-open. Also, please note (although it may not affect your business/operations), the City of Cambridge is not opening indoor performance venues used for live performances and other indoor performance spaces not designated as Phase IV enterprises until March 22, 2021, and until they have been inspected by and received approval from the City’s Inspectional Services Department.

As a reminder, “restaurant” as defined by the reopening plan is “an establishment that provides food service that is prepared on-site and under a Food Service Establishment Permit, for food service establishments that cook, prepare and serve food, intended for immediate consumption, as permitted and issued by a municipal authority pursuant to 105 CMR 590.000. Potato chips, pretzels, and other similar pre-packaged, shelf stable foods, or other food prepared off-site, do not constitute food “prepared on-site.”

Finally, any restrictions placed by the City of Cambridge, which are more restrictive than the State’s, is controlling. Attached for your convenience are the State’s Order, the City’s Order (including the September one regarding bar seating areas), the mandated Restaurant protocols, guidelines and checklists, and the Alcoholic Beverages Control Commission related advisory (for those who are licensed to serve alcohol).

Any questions, please let me know.

Thank you, stay safe.

Nicole Murati Ferrer, Esq., Chair

Cambridge License Commission

Pole and Conduit Commission

831 Massachusetts Avenue

Cambridge, MA 02139

(617) 349-6140

Website: www.cambridgema.gov/license

Application/Renewal Portal: https://cambridgema.viewpointcloud.com/

February 12, 2021

Below and linked here is the City’s announcement for upcoming free workshops/info sessions on indoor ventilation best practices.

The City, working with Environmental Health and Engineering, Inc. will be providing sector specific Q&As and follow up small group sessions. Folks can register here or below for specific sectors.

Please share with your networks!

We still have “Mask Up” materials. Let me know if you would like a stack (table tent image attached, also have cards).

Thanks and have a great weekend!

Lisa and Matt

Small Business Info Sessions on Indoor Ventilation Best Practices during COVID-19

2/12/2021

The City is working with Environmental Health and Engineering, Inc. to provide small businesses with information on common approaches to improve indoor ventilation designed to protect people during the current Pandemic.

This new program provides two opportunities for businesses to receive assistance. The first opportunity is sector specific question and answer info sessions. These sessions will provide Cambridge small businesses a chance to ask experts in public health and mechanical systems questions and receive information to assist in the safe operation of the business’ facilities. These sessions will be open and can include 100 businesses per session.

The second opportunity is small group follow-up sessions. These will be half-hour sessions that will provide a small group of businesses with time to ask questions that are specific to their location. These sessions will be limited six (6) businesses per session, and will be on a first come, first serve basis.

Sessions are free and only available to Cambridge businesses.

The materials and information provided at the sector specific question and answer info sessions and small group follow-up sessions are not created by the City of Cambridge and the City of Cambridge does not adopt any positions contained therein. Any questions on the materials and information provided should be directed to EH&H and not the City of Cambridge.

Opportunity #1: Question and Answer Information Sessions

Session One: COVID-19 Control Strategies for Personal Services and Fitness Sectors

- When: Friday, February 26, 1:00 p.m. – 2:00 p.m.

- Where: Online. After registration, businesses will receive a link to access the online session and instructions on the platform.

- This session is for salons, barbershops, spas, gyms, and other personal service businesses that have questions related to COVID-19 control strategies for indoor operations.

- Click here to register.

Session Two: COVID-19 Control Strategies for Restaurants & Cafes

- When: Wednesday, March 3, 2:00 p.m. – 3:00 p.m.

- Where: Online. After registration, businesses will receive a link to access the online session.

- This session is for restaurants, coffee shops, and other food related businesses that have questions related to COVID-19 control strategies for indoor operations.

- Click here to register.

Session Three: COVID-19 Control Strategies for Retail & Small Office Establishments

- When: Friday, March 12, 11:00 a.m. – 12:00 p.m.

- Where: Online. After registration, businesses will receive a link to access the online session.

- This session is for retailers and small office-related businesses that have questions related to COVID-19 control strategies for indoor operations.

- Click here to register.

Opportunity #2: Small Group Follow Up Sessions

Dates coming soon.

For more information

Question and Answer Information Sessions will be recorded. If you are interested in receiving a recording to a session or have questions about the program, please contact Pardis Saffari at psaffari@cambridgema.gov or 617-349-4654.

February 5, 2021

On February 4, 2021, the Governor of Massachusetts announced that as of Monday, February 8, 2021, the capacity limits for certain businesses will increase from the current 25% to 40%. After careful consideration, the City of Cambridge has adopted the increase but will continue to monitor and amend if necessary in the interest of the public’s safety.

Attached are the State’s updated mandatory guidelines and protocols for restaurants (hotels, entertainment venues as well as others have not yet been updated by the state). In addition, for more information on the current capacity limits and the updated capacity limits, please visit the state’s website at: https://www.mass.gov/info-details/temporary-capacity-and-gathering-limits#limits-beginning-5:00-am-on-february-8,-2021-. For those who are licensed to serve alcohol, attached is the corresponding Alcoholic Beverages Control Commission’s Advisory.

Important things to note:

- On-Premises Consumption Licensees (a/k/a restaurants), as of Monday, February 8, you may seat up to 40% of your licensed seating capacity inside and 40% of your licensed seating capacity outside.

- Even with the increase, tables must be positioned to maintain at least a 6 foot distance from all other tables and any high foot traffic areas.

- Do not count your employees towards the count.

- Do not combine the indoor and outdoor capacities.

- Do not calculate the 40% off your total occupancy or standing capacity, there should be no standing service (only persons standing should be those coming in to pick up orders). The 40% is calculated off the seating capacity only.

- In Cambridge the seating capacity as listed on your license is controlling.

- Maximum of 6 persons at a table remains in effect.

- Table/seating service 90-minute limitation remains in effect.

- If you are licensed to serve alcohol, it must be with food.

- Off-Premises Consumption Licensees (a/k/a package stores), your 40% is based off the capacity as listed on your Certificate of Inspection. If you do not have one, there is a limit of 5 persons per 1,000 square feet.

- Do not count your employees towards the count.

- Please send questions as to the maximum capacity allowed in your space to ranjits@cambridgema.gov, sdaglian@cambridgema.gov, or atuccinardi@cambridgema.gov.

- Hotels, the 40% applies to common areas only; you may lodge at full capacity. Your restaurants must abide by the 40% restrictions as explained above.

- Movie theaters, the 40% capacity applies as to each theater/room but with a maximum of 50 persons per theater/room.

- If you are licensed to serve alcohol, it must be in conjunction with food.

As always, you must abide and comply with all State Orders, City Orders and our Rules and Regulations. In the event that any City Order is more restrictive, you must abide by the City Order. Please be advised inspections will be conducted to ensure compliance with the capacity limits.

I also remind everyone that face masks are required to be worn by all persons, including employees, at all times. Customers at any place of public accommodation must have their face masks on unless they are actively consuming food or beverages. Please note there are medical exceptions to the face mask orders (also not required for children under 2 years old).

Finally, although the Patriots did not make the Super Bowl, there are many persons still interested in watching it this Sunday. Make sure you are operating your businesses safely, responsibly and within the current 25% capacity limits.

Thank you, stay safe.

Nicole Murati Ferrer, Esq., Chair

Cambridge License Commission

Pole and Conduit Commission

831 Massachusetts Avenue

Cambridge, MA 02139

(617) 349-6140

Website: www.cambridgema.gov/license

Application/Renewal Portal: https://cambridgema.viewpointcloud.com/

January 29, 2021

CITY OF CAMBRIDGE TO RETURN TO PHASE III, STEP 1 BEGINNING MONDAY, FEBRUARY 8

The City of Cambridge announced that it is extending its rollback to a modified Phase II, Step 2 of the Commonwealth’s Reopening Massachusetts Plan for one week and will be returning to Phase III, Step 1 effective on Monday, February 8 at 12:00 a.m.

Additionally, in-person appointments at City buildings will resume the week of February 8 with appointments available on Tuesdays and Thursdays each week. Contactless holds pick-up at the Cambridge Public Library will also resume the week of February 8. Holds pickup will resume on Monday, February 8 at Central Square Branch and Valente Branch; Tuesday, February 9 at the Main Library; and Wednesday, February 10 at O’Neill Branch. The full schedule of hours and additional details will be posted on the library website at www.cambridgema.gov/cpl.

While City buildings will remain closed to the public on Mondays, Wednesdays, and Fridays, City offices will be open, and many City services can be accessed online or over the telephone. A complete listing of City departments as well as contact information and instructions on how to book in-person appointments can be found at www.cambridgema.gov/hours.

Upon expiration of the City’s Temporary Emergency Order Requiring a Modified Rollback to Phase II, Step 2 of Governor Baker’s Reopening Plan in the City of Cambridge, the City will return to Phase III, Step 1 of Governor Baker’s Reopening Plan effective on Monday, February 8 at 12:00 a.m. unless further extended by subsequent order.

In accordance with Phase III, Step 1, the following sectors will be allowed to reopen in Cambridge beginning at 12:00 a.m. on Monday, February 8, 2021 while following all state sector specific guidelines:

- Museums

- Indoor historic spaces/sites

- Movie theaters

- Sightseeing and other organized tours

- Indoor events spaces such as meeting rooms, ballrooms, and private party rooms

- Indoor recreational activities such as batting cages, driving ranges, go karts, bowling alleys, rock-climbing walls

The following additional City restrictions on fitness centers will continue to apply:

- Fitness centers and health clubs may only operate at 25% capacity and in accordance with the following requirements:

- Locker room/changing room capacity at indoor fitness centers and health clubs shall be limited to 1 person per 200 square feet;

- Customers of fitness centers and health clubs shall only utilize the facility for a ninety (90) minute time period, per day

The City of Cambridge will continue to take a cautious and measured approach to activities and industries permitted in Cambridge and will continue to closely monitor public health data as part of its decision-making process.

View full text of the City of Cambridge Order Extending Temporary Emergency Order Requiring a Modified Rollback to Phase II, Step 2 of Governor Baker’s Reopening Plan in the City of Cambridge that was issued on January 29, 2021.

For more information and to sign up to receive updates on COVID-19 and vaccine-related information, please visit the City’s dedicated information page: https://www.cambridgema.gov/covid19

January 22, 2021

Dear All:

As you may have seen, yesterday the Governor announced that on Monday, January 25, 2021, Sections 1 and 2 of COVID-19 Order No. 53 and Section 1 of COVID-19 Order No. 57 will be rescinded – these are the ones that mandated your businesses/events to close at 9:30 p.m. As of Monday, January 25, 2021, you may operate pursuant to your licensed hours as stated on your 2021 License issued by the Board of License Commissioners. The limitations on capacity (25% for most), however, remain in effect until February 8, 2021, unless further extended. I have attached COVID-19 Order No. 62, which contains more details. Also attached, for those who are currently licensed and approved to sell/serve alcohol, is the corresponding ABCC Advisory.

Please note, the City of Cambridge remains in Phase 2, Step 2 which means that regardless of the State Orders, there are certain businesses, or portions of your businesses, that must continue to be closed until February 1, 2021, unless further extended. For your convenience, I have attached that Order too.

We continue to work with public health officials to ensure the safety of all. Please continue to abide by all Orders, and remember that the City of Cambridge’s Orders are controlling. I also take this opportunity to remind everyone that at all times, employees and customers must wear face masks, except when in the active engagement of eating or drinking.

Any questions, please let us know.

Thank you, stay safe.

Nicole Murati Ferrer, Esq., Chair

Cambridge License Commission

Pole and Conduit Commission

831 Massachusetts Avenue

Cambridge, MA 02139

(617) 349-6140

Website: www.cambridgema.gov/license

Application/Renewal Portal: https://cambridgema.viewpointcloud.com/

January 15, 2021

This page on the Mass.gov website includes a map of COVID-19 vaccine locations with contact details and sign-up information for individuals currently eligible to be vaccinated. Sites will be added in the coming weeks and appointments will be released on a rolling basis. Individuals will need to provide proof of their eligibility at the site. Learn More.

What’s New

COVID-19 Case Count

A total of 3,722 Cambridge residents have tested positive for COVID-19 since the coronavirus outbreak began. There are currently 834 active cases in Cambridge, with 54 newly reported case(s) today. There have been 111 confirmed COVID-19 deaths, with 0 newly reported death(s) today, and 2,128 recoveries in Cambridge residents as of January 14, 2021.

- Access Massachusetts COVID-19 data

- Access Massachusetts Weekly COVID-19 Health Report

- Access Harvard University COVID-19 data

- Access MIT COVID-19 data

Access Cambridge Public Schools COVID-19 data

December 29, 2020

Cambridge Begins Rollback to a Modified Phase II, Step 2 for Three Weeks

Temporary Emergency Order Requiring a Modified Rollback to Phase II, Step 2 of Governor Baker’s Reopening Plan in the City of Cambridge requires the following additional mandatory closures beginning at 12:00 a.m. on Saturday, December 26, 2020 for a three-week period until 12:00 a.m. on January 16, 2021, or until further modified:

• Museums

• Indoor historic spaces/sites

• Movie theaters

• Sightseeing and other organized tours

• Indoor events spaces such as meeting rooms, ballrooms, and private party rooms

• Indoor recreational activities such as batting cages, driving ranges, go karts, bowling alleys, rock-climbing walls

In Cambridge, the following Phase III, Step 1 sectors will be allowed to operate, in accordance with capacity limits set forth in Governor Baker’s COVID-19 Order # 59, with additional City restrictions beginning at 12:00 a.m. on Saturday, December 26, 2020 for a three-week period until 12:00 a.m. on January 16, 2021, or until further modified:

• Fitness centers and health clubs may only operate at 25% capacity and in accordance with the following requirements:

• Locker room/changing room capacity at indoor fitness centers and health clubs shall be limited to 1 person per 200 square feet;

• Customers of fitness centers and health clubs shall only utilize the facility for a ninety (90) minute time period, per day;

• Indoor recreational and athletic facilities for general use (not limited to youth programs) may only operate at 25% capacity.

• Youth sports activities and programs are permitted in accordance with the Commonwealth’s Workplace Safety and Reopening Standards for Businesses and Other Entities Providing Youth and Adult Amateur Sports Activities – Phase III, Step 1, amended on December 9, 2020 and effective on December 13, 2020.

• Outdoor theatres and other outdoor performance venues not designated as Phase IV enterprises may continue to operate and do not have to close, however, may only operate with a capacity of twenty-five (25) people.

• Outdoor event spaces used for gatherings and celebrations including those in parks reservations, and other outdoor spaces not designated as Phase IV enterprises may continue to operate and do not have to close, however, may only operate with a capacity of twenty-five (25) people.

• Indoor non-athletic instructional classes art/education/life skills for persons 18 years or older may continue to operate and do not have to close, however, may only operate with a capacity of ten (10) people or at 25% capacity, whichever is less.

November 5, 2020

| Executive Order & Early Closure of Certain Businesses and Activities Please note this message is intended for Cambridge businesses, per the Cambridge License Commission: As of tomorrow, Friday, November 6, 2020, certain businesses and activities must close by 9:30 p.m. (or at your licensed hour, if earlier than 9:30 p.m.). Establishments may continue to provide take-out and delivery service of food and non-alcoholic beverages up to your licensed closing hour (if later than 9:30 p.m.), but no customer is allowed inside the premises after 9:30 p.m. Employees may remain on-premises after 9:30 p.m. if in the process of cleaning and/or preparing take-out and delivery orders. Customers/delivery services coming to pick up take-out or delivery orders must remain outside the premises (you may bring the food to them at the door). If you are licensed to sell alcohol, you must cease selling and serving alcohol at 9:30 p.m. and cannot sell alcohol to go/for delivery after 9:30 p.m. Contained in the below URL is the Governor’s Order with more information, including the full list of businesses impacted, and attached is the corresponding ABCC Advisory. This is a state-wide curfew/Order and it must be adhered to as explained here. Alert sent on 11/05/2020 at 1:46PM EST Additional Information Link: New Orders & Advisories Attachment: Download ABCC Advisory Submit an Anonymous Tip To submit a tip via text message text TIP650 and your tip to 847411 Alert delivered to the following groups: Business Alerts, Private – Harvard Square Business Association, Private – Central Square Business Association, Private – Inman Square Business Association, Private – East Cambridge Business Association, Private – Kendall Square Business Association, Kendall Square Security Network Association, Private – Cambridge Public Safety Association, Private – Cambridge Hotels, Private – Cambridge Banks, Private – Cambridge Biotechs, Private – Porter Square Business Association, Private – Cambridge Security, Private – Cambridge Real Estate, Private – Cambridge Retail, and Private – CPSA Master View Online | Translate | Share Alert Link to Agency |

November 3, 2020

For specific questions please contact me directly at mirish@oneillandassoc.com or at 617-957-4403.

For additional information on COVID-19 including what’s happening in Massachusetts, Connecticut and the City of Boston please check out the dedicated section on our website URL: https://www.oneillandassoc.com/sba-assistance-forms-fact-sheets including a review of passed federal legislation pertaining to the Covid-19 response.

If anyone on this distribution list would also like to receive regular updates specific on issues related to the Federal Government, Boston or Connecticut please contact me and we can add you to those lists. The O’Neill and Associates website is also regularly updated with all of that information, the link is included above.

- As of Monday night, DPH reported a total of 156,385 cases of COVID-19.

- The state has now confirmed a total of 9,797 deaths from the virus.

- The number of confirmed and probable deaths caused by COVID-19 surpassed 10,000 over the weekend as 2,431 new people tested positive for the virus and new daily cases detected continues to exceed 1,000 a day.

- The Department of Public Health reported 1,292 new confirmed cases of the deadly coronavirus on Saturday and another 1,139 on Sunday.

- The totals stemmed from 34,846 new individuals tested for COVID-19.

- With the 38 newly reported deaths of people confirmed to have had the virus, the toll in Massachusetts climbed to 10,013 confirmed and probable deaths from COVID-19, including 9,788 from confirmed cases of the virus.

- Daily counts of more than 1,000 new cases are now the norm in Massachusetts as the predicted virus resurgence has come to pass.

- Public health and government officials, however, say the state is better prepared to respond to the virus than in the spring when COVID-19 was a new disease and hospitals feared becoming overrun.

- Based on the ways the state calculates positive testing rates counting people who are tested frequently, the state’s rate dropped to 1.8 percent over the weekend from a high of 2 percent last week.

- In an attempt to make the publicly released COVID-19 data more useful, the Department of Public Health has reorganized the daily “dashboard” that reports on new cases, testing and other metrics, and the department on Monday will begin reporting on case growth by age group and the impact of university testing on broader state trends.

- Secretary Sudders said the new daily report will also allow researchers and members of the public view trend lines that go back to March and also for the past six weeks.

- The separating out of COVID-19 case growth by age coincides with recent warnings from the administration that spread among people under 30 has become more prevalent that among those over 60, which is a reverse from the early days of the pandemic.

- Too many people in Massachusetts have let down their guard when it comes to protecting against the coronavirus that has killed more than 10,000 people here since mid-March and the state must take steps now to slow the spread of the virus or else hospitals will be overrun with COVID-19 patients by the holidays, Governor Baker said Monday.

- Starting Friday, everyone above the age of five in Massachusetts will be required to wear a mask or facecovering indoors and outdoors in public, regardless of whether social distancing is practiced, and restaurants and entertainment venues will be subject to a 9:30 p.m. curfew, the governor announced.

- The state’s indoor gathering limit will be lowered to 10 people, down from 25, as well.

- The governor said his decision to put more restrictive measures in place was made after consultation with public health experts whom he said “are increasingly concerned about the virus’s spread and the uptick it creates in hospitalizations.”

- He said health care workers are becoming alarmed by the state’s recent resurgence.

- Boston Mayor Marty Walsh said Monday morning that he had spoken with Baker about the new orders and supports them “wholeheartedly.”

- The House sent legislation to the Consumer Protection and Professional Licensure Committee on Monday that would allow businesses to retain their alcohol licenses for up to a year after ceasing operations due to the COVID-19 pandemic.

- Representatives also approved local bills and an extension order for legislation related to Clinton’s police chief.

- No clues surfaced during Monday’s session about what the House might take up on Thursday, when Democratic leadership informed members of a potential full formal session.

- The House will meet in an informal session on Wednesday.

- In July, Senate President Emerita Harriette Chandler and emergency department doctor Rep. Jon Santiago filed a bill that would legislate mandatory face-covering usage during the current state of emergency in a manner similar to Governor Baker’s May 1 executive order.

- Four months later, the Senate on Monday sent the bill (SD 3005) to the Public Health Committee where lawmakers can begin to review it.

- The bill also contains elements similar to other orders from Baker including a quarantine period for interstate travelers.

- Governor Baker’s authority to institute those orders on his own is currently under legal challenge before the Supreme Judicial Court in Desrosiers v. Baker, on which the state’s highest court heard arguments in September.

- The rest of the Senate’s election eve agenda was mainly local bills and sick leave banks.

- The House has blocked off Thursday for a possible formal session, while the Senate plans to meet informally Thursday at 11 a.m.

- State lawmakers will take up legislation related to abortion and reproductive health care at some point in the next two months, Democratic leaders announced Monday, setting the table for a rare high-profile debate after elections are complete.

- With legislation governing abortion access hung up in committee since early 2019, House Speaker Robert DeLeo and Senate President Karen Spilka said in a brief joint statement that they are “committed” to holding debate by the end of the current lawmaking session, though they offered few details on what shape the legislation will take.

- It is not clear if DeLeo and Spilka were referring to the so-called ROE Act (H 3320 / S 1209), which would eliminate parental consent requirements for teenagers seeking abortions, permit abortions after 24 weeks of pregnancy in limited cases, and require insurance coverage of abortions for state residents who are not eligible for MassHealth.

- Those bills have been cosponsored by a majority of members in each branch, but they have been sitting before the Judiciary Committee for more than a year.

- The joint announcement expands the field of legislation in play for the lame duck stretch between Tuesday’s general elections and the start of the next two-year lawmaking session in January.

- Governor Baker activated up to 1,000 members of the Massachusetts National Guard on Monday as one step in preparations to ensure Massachusetts “is positioned to maintain public safety following Tuesday’s election,” his administration said.

- Secretary of Public Safety Tom Turco said there is “no indication of any public safety risk in Massachusetts” but that the administration is making resources are available in case municipal officials request state assistance.

- The National Guard has been similarly activated a few times in recent months without its members being pressed into duty.

- Another 1.3 million people are projected to cast their ballots on Tuesday, and when added to the 2.3 million people who have already voted the anticipated turnout would set a new record during an intense and unusual presidential election cycle.

- Secretary of State William Galvin on Monday forecast that total turnout would surpass the 3.3 million record set in the 2016 presidential election, by more than 300,000 people.

- He said polling places, which will be open from 7 a.m. until 8 p.m. Tuesday, will be safe from a public health standpoint, with COVID-19 precautions in place, and that elections officials are expecting a “very orderly day.”

- More than 4.8 million people are now registered to vote in Massachusetts, according to Galvin, who said there has been “a consistent increase in voter registration” and a decline in the number of inactive voters.

- Several major property owners representing hundreds of thousands of rental units nationwide agreed Monday to pause evictions for failure to pay rent until 2021 and to work with tenants who are struggling amid the COVID-19 pandemic, the Greater Boston Real Estate Board announced.

- By signing the board’s housing stability pledge, property holders and landlords said they would communicate with tenants experiencing financial hardship about emergency support programs that could help them cover rent.

- They also said they will pursue repayment plans and seek mediation as first steps before turning to formal eviction proceedings.

O’Neill & Associates

18 Tremont Street, Suite 600

Boston, MA 02108

Mobile – 617-957-4403

October 14, 2020

September 28, 2020

On September 22, 2020 Governor Baker put out some updated restaurant safety guidelines which become effective on Monday, September 28, 2020 (“State’s September 28 Restaurant Guidelines”). On September 24, 2020, the Alcoholic Beverages Control Commission (“ABCC”) put out a corresponding Advisory (“ABCC September Restaurant Advisory”). Today, the City of Cambridge issued a related and corresponding Temporary Emergency Order Regarding Restaurant Operations (“Cambridge September 2020 Restaurant Order”). All Cambridge licensees must abide by the Cambridge September 2020 Restaurant Order, which is the controlling order in the City of Cambridge.

Based on the Cambridge September 2020 Restaurant Order, restaurants are prohibited from seating any parties larger than 6 people. In addition, based on the Cambridge September 2020 Restaurant Order restaurants are prohibited from seating people in the bar area at least until October 3, 2020 AND after an inspection and approval from the Cambridge Inspectional Services Department. Please note the Cambridge September 2020 Restaurant Order is controlling and you must comply with it.

Please note the State’s September 28 Restaurant Guidelines, ABCC September Restaurant Advisory, and Cambridge September 2020 Restaurant Order ALL prohibit congregation in bar areas, standing service, or the reopening of any business that is not a restaurant. As always, there must be compliance with all orders, guidance, and rules.

Any questions as to the State’s September 28 Restaurant Guidelines, ABCC September Restaurant Advisory, Cambridge September 2020 Restaurant Order or any operational changes, please email me or send an email to license@cambridgema.gov. Any questions on how to schedule an inspection with Inspectional Services Department for the approval of the reconfiguration of the bar area, please send to ranjits@cambridgema.gov, or call ISD at 617-349-6100.

July 22, 2020

Dear All:

In an attempt to assist the restaurant business during this COVID-19 pandemic, yesterday the Governor signed into law the bill that allows restaurants such as yours to sell cocktails as a to go/delivery item when the customer is purchasing a food order to go or for delivery. This is in addition to the previous law enacted allowing the sale of malt and/or wines with food to go/delivery orders.

Please note that there are various limitations which are detailed on the attached Alcoholic Beverages Control Commission (“ABCC”) Advisory, and with which you must comply. Such limitations, include but are not limited to: cocktails can only be sold in conjunction with the purchase of food (business must keep copies of receipts and produce to licensing authority for inspection); the cocktail must be prepared with the same proportions as if being prepared for on premises consumption; the cocktail must be packaged in a sealed container and if such container has a hole for a straw/sipping, that hole must be further sealed (tape is allowed); the business must ensure the purchaser and recipient of the item is at least 21 years old; each customer is limited to a maximum of 64 fluid ounces of mixed drinks per transaction; and the drinks must be transported in the trunk of the vehicle or some other area which is not considered a passenger area.

Regardless of this and other emergency laws passed due to this pandemic, all other laws, rules and regulations regarding the sale and/or delivery of alcohol continue to apply and will be enforced. In addition, all licensees are expected to continue to abide and comply with all of the Laws of the Commonwealth of Massachusetts, City of Cambridge Ordinances, and any rules, regulations, advisories and guidance issued by the Governor, ABCC, City of Cambridge and Board of the License Commissioners.

Click here to apply online

July 15, 2020

For more information click here

July 9, 2020

On Tuesday July 14 at 11 AM, Evan Murphy and Meghan Avery of UTCA will be discussing the issues of unemployment insurance and the CARES Act.

The Cares Act has put emergency provisions into the state unemployment insurance systems giving richer benefits than ever before, for longer periods.

While this is a huge relief to employees affected by Covid-19, many furloughed workers are now earning substantially more on unemployment than their employer paid them while working. As the 7/31 deadline for the additional $600 weekly UI “boost” comes to an end, many employers are struggling in their recall efforts and are questioning what their options are to deal with reluctant or non-responsive employees.

Please join us for an interactive session that will address:

· Financial risk of Covid-19 unemployment charges to for-profit and non-profit businesses

· How to properly track and protest your charges

· Best practices for implementing your recall process to limit UI liability

· “Good cause” for refusing to return to work

An update of current state of the UI system will be followed with a question and answer period in an interactive chat session. Registrants are encouraged to pose any questions they may have relative to their workforce and impacted states of operation.

We invite your questions in advance to Meghan Avery at mavery@utcainc.com.

July 2, 2020

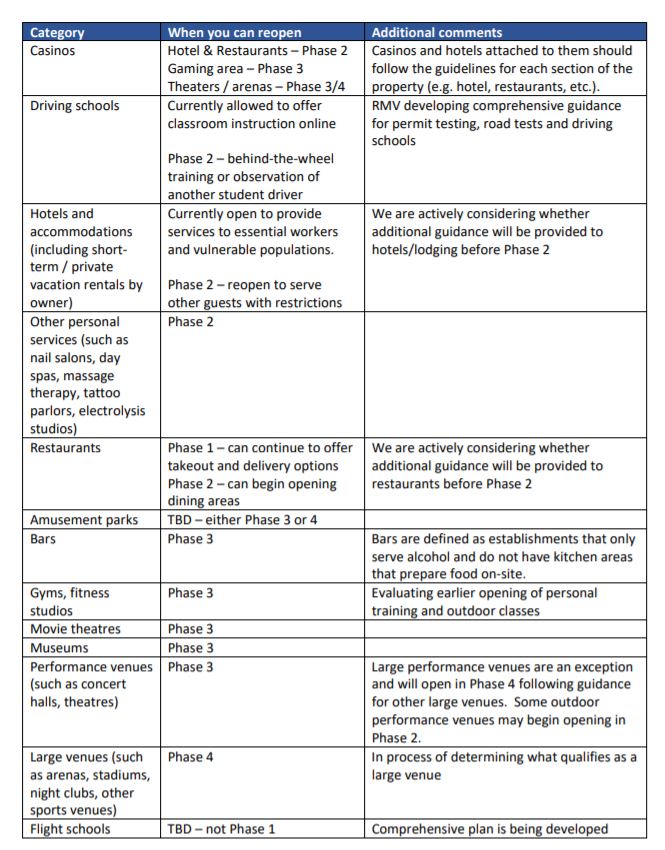

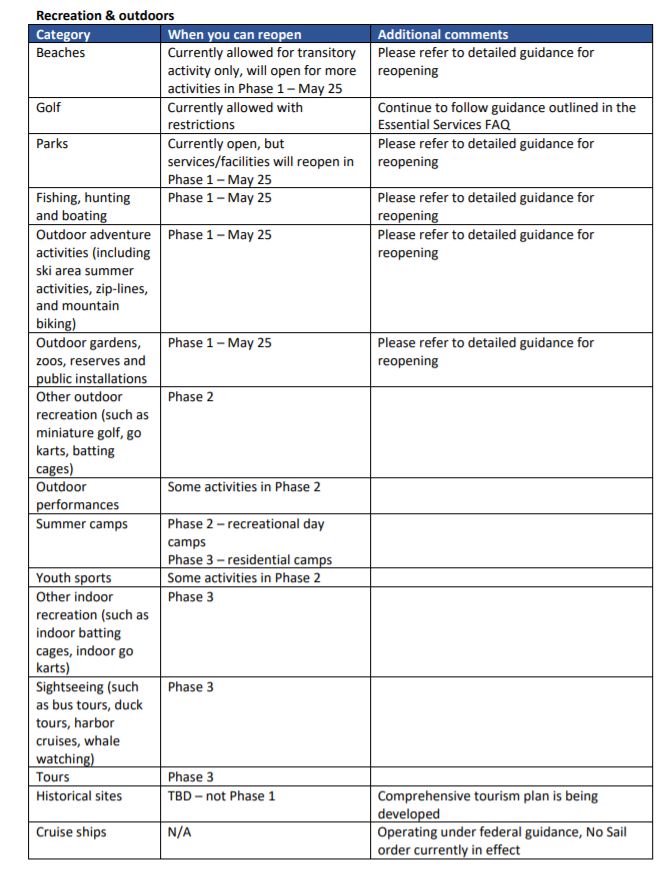

Phase III will operate under a two-phase schedule, like Phase II. There is no date for when the 2nd part of Phase III will begin.

Beginning Monday, gyms, fitness centers, museums, cultural and historical facilities will be allowed to reopen, and small guided tours may resume. However, there are specific restrictions and guidelines they must follow.

Also, indoor gatherings are limited to eight people per 1,000 square feet but should not include more than 25 people. Gatherings in enclosed outdoor spaces are limited to 25 percent or 100 people.

More information available here.

June 30, 2020

June 24, 2020

As Massachusetts moves further into Phase 2 of reopening its economy more industry sectors are now moving toward operating

On Monday, the following became eligible to reopen:

· Indoor table service at restaurants;

· Close contact personal services, with restrictions;

· Retail dressing rooms, by appointment only;

· Offices, at 50 percent capacity

Guidance from the state includes staggering shifts, when to notify a board of health of potential infections, and removal of non-essential items from the area.

Currently, activity is not allowed without meeting COVID-19 workplace safety standards. These standards apply to all enterprises permitted to operate until rescinded or amended by the State, unless where sector-specific standards are applicable, in which case enterprises must follow those sector-specific standards. The state has provided a checklist of these general activities.

Even if your business is not currently operating in Phase II, we would recommend you consider these activities as they are likely to persist into later steps of Phase II or into Phase III.

Reopening For Business – Free Webinar

With staffing remaining light, remote work continues to flourish. With recent news of Unemployment fraud using stolen personal information, cyber-security should be at the forefront of any business owners’ mind.

As part of our summer series of webinars around the issues of reopening, our first presentation will address remote IT security.

On July 7 at 11 AM, Jay Small of Cinch IT will present “Sanitizing Your IT Network and Infrastructure.” With so many companies running on increased work-from-home arrangements the inevitable security concerns arise: cyber-security, compliance issues, phishing attacks and the like. Join us for a free discussion of the concerns around our new working realities. To register for this free webinar, click here.

COVID Antibody Testing Unlawful

The EEOC has determined that while testing for active COVID infection is permissible, mandatory testing for COVID antibodies is not job related and is therefore not permissible – the difference being determining active infection vs. previous infection. As the science evolves, this position could change.

Employers can still choose to offer antibody testing, but an employee’s decision to take the test must be knowing and voluntary and in most states, the employer is responsible for paying for the test.

CIP can help assist you in setting up a COVID infection testing protocol. Email us at rapidresponse@askcip.com for information.

Supreme Court Expands Title VII Protections To Include Gender Identity and Sexual Orientation

The Supreme Court decided a landmark case expanding Title VII protection to Gender Identity and Sexual Orientation. While this doesn’t necessarily affect Massachusetts employers as state civil rights law is broader than Federal Law, employers now have liability at the Federal level. Employers should review their harassment and discrimination policies to include these protections.

PCORI Fee Due July 31, 2020

Under the Patient Protection and Affordable Care Act (PPACA), fees are assessed for some self-insured health plans. The Comparative Effectiveness Research Fee (CERF) is designed to help fund the Patient-Centered Outcomes Research Institute (PCORI), an independent, nonprofit organization authorized by Congress in 2010 designed to fund medical research that will provide patients, their caregivers, and clinicians with the evidence-based information needed to make better-informed healthcare decisions.

More information can be found on our website

June 22, 2020

June 17, 2020

Please find below guidance for employers for communication with the Cambridge Public Health Department regarding employees suspected of or confirmed with COVID19.

June 12, 2020

The City has established procedures for restaurants that want to operate outdoor dining service in Phase II of the Commonwealth’s Re-Opening Plan. Restaurants that already have approval for outdoor dining areas on private property and are seeking temporary approval to extend the area/footprint: • You may commence outdoor dining service in the currently approved footprint area upon the Governor’s announcement that restaurants may open on June 8, 2020 for outdoor dining service in Phase II. • You must comply with all social distancing guidelines and safety measures released by the Governor’s Office on May 29, 2020. • To get temporary approval for the additional area, you must submit through your Viewpoint account an application for Temporary Outdoor Extension of Licensed Premises Due to COVID19. See below for the application requirements APPLICATION REQUIREMENTS: (1) Copy of the floor plan showing the dimensions of the area (including the square footage), where the tables and chairs will be located, the distance (in dimensions) of the space between tables/chairs, the location of the hostess stand (if applicable), location of sanitizing station, the total capacity of the area, the barriers (including material and dimensions) proposed to be used to delineate and secure the outdoor area, any existing street furniture, infrastructure or tree grates, and if the proposed area is on a sidewalk, the dimensions of the remaining passable sidewalk, which must be no less than four feet (4’). The floor plan does not have to be stamped by an architect, but it must depict accurate dimensions. (2) For private property, copy of the lease/letter of intent showing that you have the right to occupy the area. (3) [If extending to public property] Indemnification Agreement. (4) [If extending to public property and seeking to serve alcohol along with food in outdoor area] Sidewalk/Street Restaurant Patio License, Maintenance and Indemnification Agreement completed by the Applicant. (5) [If extending to public property] $5000 Sidewalk Obstruction or Permit Bond. (6) [If seeking to serve alcohol along with food in outdoor area] Proof of liquor liability insurance. (7) [If extending to public property] Photo of sidewalk and/or street area of proposed patio location. (8) Photo of barriers being used to separate area from vehicle, bicycle and pedestrian traffic. (9) Any other document/information necessary and as requested by the City of Cambridge.

June 11, 2020

Key aspects of the changes to the PPP:

· Extends the eight-week period under which loan recipients can spend the PPP money from eight weeks to 24 weeks, or until Dec. 31.

· Removes the limits on loan forgiveness for small businesses that were unable to rehire employees, hire new employees or return to the same level of business activity as before the virus.

· Expands the 25% cap to use PPP funds on nonpayroll expenses, such as rent, mortgage interest and utilities, to 40% of the total loan. That lowers the 75% requirement for payroll expenses to 60%.

· Extends the loan terms for any unforgiven portions that need to be repaid from two years to five years.

· Extends the period for when a business can apply for loan forgiveness, from within six months to within 10 months of the last day of the covered period.

· June 30, 2020 remains the last date on which a PPP loan application can be approved.

More information here.

June 6, 2020

The following businesses will be eligible to reopen in Step One of Phase II on June 8, with contingencies:

- Retail, with occupancy limits;

- Childcare facilities and day camps, with detailed guidance;

- Restaurants, outdoor table service only;

- Hotels and other lodgings, no events, functions or meetings;

- Warehouses and distribution centers;

- Personal services without close physical contact, such as home cleaning, photography, window washing, career coaching and education tutoring;

- Post-secondary, higher education, vocational-tech and occupation schools for the purpose of completing graduation requirements;

- Youth and adult amateur sports, with detailed guidance;

- Outdoor recreation facilities

- Professional sports practices, no games or public admissions;

- Non-athletic youth instructional classes in arts, education or life skills and in groups of less than 10;

- Driving and flight schools

- Outdoor historical spaces, no functions, gatherings or guided tours;

- Funeral homes, with occupancy limits

The following businesses will be eligible reopen in Step Two of Phase II at a later date to be determined:

- Indoor table service at restaurants

- Close-contact personal services, with restrictions, including:

- Hair removal and replacement

- Nail care

- Skin care

- Massage therapy

- Makeup salons and makeup application services

- Tanning salons

- Tattoo, piercing and body art services

- Personal training, with restrictions

June 3, 2020

May 19, 2020

As of Monday May 18th, the DPH reported a total of 87,052 cases of COVID-19. The state has now confirmed a total of 5,862 deaths from the virus.

- Governor Baker released his economic re-opening plan at a Monday press conference and DPH issued an updated “Safer at Home” advisory.

- The new Safer at Home Advisory instructs everyone to stay home unless they are headed to a newly opened facility or activity.

- It also advises those over the age of 65 and those with underlying health conditions to stay home with the exception of trips required for health care, groceries, or that are otherwise absolutely necessary.

- All residents must continue to wear a face covering in public when social distancing is not possible, and individuals are advised to wash their hands frequently and be vigilant in monitoring for symptoms.

- Restrictions on gatherings of more than 10 people remain in effect.

- The administration plan calls for a phased re-opening with a goal of full operations in a “new normal”.

- Key public health metrics will determine if and when it is appropriate to proceed through reopening phases. They include:

- COVID-19 positive test rate

- Number of individuals who died from COVID-19

- Number of patients with COVID-19 in hospitals

- Health care system readiness

- Testing capacity

- Contact tracing capabilities

- Manufacturing, construction and houses of worship are able to open immediately, provided they meet health and safety criteria.

- Hospitals and community health centers that attest to specific public health and safety standards can also begin to provide high priority preventative care, pediatric care and treatment for high risk patients.

- A number of other industries can open in Phase 1, next Monday, May 25th, including limited retail, office and lab space, recreational marijuana, barber shops, salons and pet groomers.

- The plan did not address childcare, K-12 or higher education.

- Restaurants are slated to re-open in phase 2, meaning a minimum of 3 more weeks, but possibly longer based on health and safety criteria.

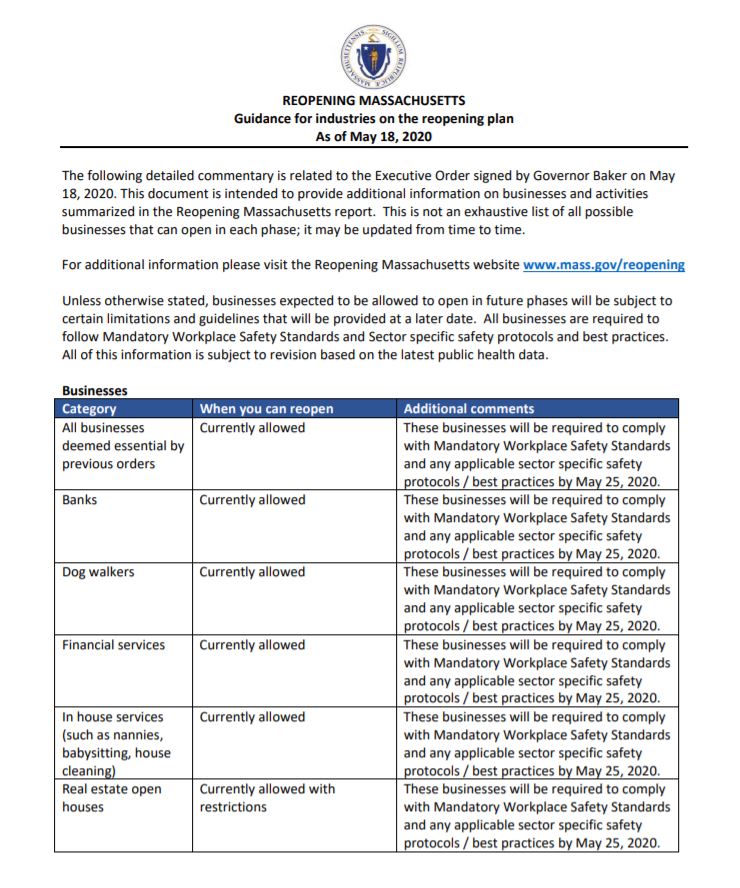

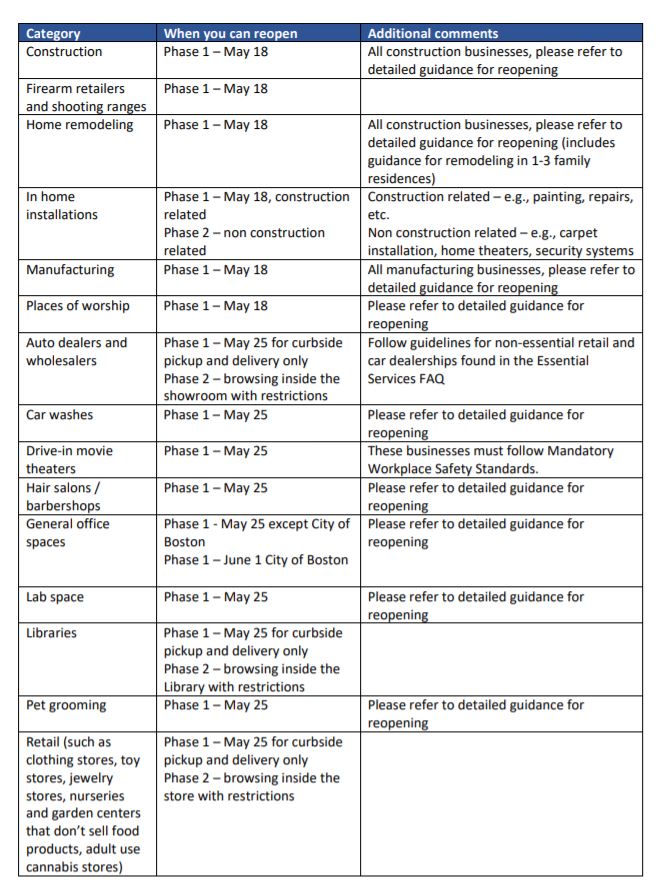

May 18, 2020

Manufacturing, construction and some health care activities are able to restart immediately, with corporate offices and other businesses allowed to open their doors May 25, all under tight restrictions.

All businesses and activities, as they reopen, must meet the following minimum safety standards:

Social Distancing:

All persons, including employees, customers, and vendors should remain at least six feet apart to the greatest extent possible, both inside and outside workplaces

Establish protocols to ensure that employees can practice adequate social distancing

Provide signage for safe social distancing

Require face coverings or masks for all employees

Hygiene Protocols:

Provide hand washing capabilities throughout the workplace

Ensure frequent hand washing and ensure adequate supplies

Provide regular sanitization of high touch areas, such as workstations, equipment, screens, doorknobs, restrooms throughout work site

Staffing and Operations:

Provide training for employees regarding the social distancing and hygiene protocols

Employees who are displaying COVID-19-like symptoms do not report to work

Establish a plan for employees getting ill from COVID-19 at work, and a return-to-work plan

Cleaning and Disinfecting:

Establish and maintain cleaning protocols specific to the business

When an active employee is diagnosed with COVID-19, cleaning and disinfecting must be performed

Disinfection of all common surfaces must take place at intervals appropriate to said workplace

All businesses must meet these requirements before reopening. Businesses operating to provide Essential Services,may remain open and have until May 25, 2020 to comply with these mandatory safety standards ALL OF WHICH ARE AVAILABLE ON THE STATE WEBSITE LINKED ABOVE

COVID-19 control plan – The state has generated a template that satisfies the written control plan requirement for self-certification

Compliance attestation poster – Poster that customer facing businesses are required to print, sign, and post in an area within the business premises that is visible to workers and visitors

Employer and Worker posters – Posters that businesses can print and display within the business premises to describe the rules for maintaining social distancing, hygiene protocols, and cleaning and disinfecting

Sector Specific Best Practices and protocols for the following are currently available on the “Reopening Massachusetts” site:

May 18 Reopening

· Manufacturing

· Construction

· Places of Worship

May 25 Reopening

· Offices spaces

· Hair Salons and Barber shops

· Car Washes

· Pet Grooming

Additionally guidance from the Executive Office of Energy and Environmental Affairs regarding recreation, including beaches, parks, mountain biking, and recreational boating was also posted

“Safer at Home” Employers are encouraged to continue remote work programs where appropriate, as everyone is safer at home.